As Invoice Volumes Grow, Tennessee Turns to Outsourced AP and AR Management for Relief

Outsourced AP/AR empowers Tennessee teams to focus on strategy while experts handle the financial details.

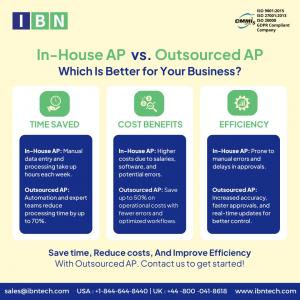

MIAMI, FL, UNITED STATES, April 17, 2025 /EINPresswire.com/ -- Companies across Tennessee are facing increasing challenges in managing core financial operations, particularly in the areas of accounts payable (AP) and accounts receivable (AR). With rising invoice volumes, delayed payment cycles, and limited internal capacity, finance departments are encountering operational bottlenecks that directly affect cash flow, reporting accuracy, and vendor relationships. As a result, outsourced AP and AR management is becoming a preferred approach for many organizations seeking to regain financial control and consistency amid mounting process complexity.Firms such as IBN Technologies are responding to this shift by offering structured and process-driven support for companies looking to stabilize their financial operations. With a focus on standardization, compliance, and around-the-clock processing, these service providers deliver dedicated AP and AR management solutions tailored to the evolving needs of businesses in Tennessee. Their offerings are designed to align with internal finance systems while improving visibility, AP/AR efficiency, and accuracy in key financial workflows.

Better AP & AR starts with one conversation.

Book Now: https://www.ibntech.com/free-consultation/

Financial Departments Under Operational Pressure

Tennessee-based finance teams are operating under heightened strain due to the growing transactional workload and the need for timely and accurate reporting. What was once managed efficiently in-house has now evolved into a more demanding task, especially for mid-sized and large businesses balancing expansion with resource constraints.

Among the most frequently reported issues are:

1) Delays in invoice approval and payment execution, causing disruptions in vendor relationships

2) Extended Days Sales Outstanding (DSO), leading to slower inflows and cash constraints

3) Inadequate follow-up capacity for overdue receivables and payment reminders

4) Inaccurate or delayed application of cash receipts, affecting ledger clarity

5) Time-intensive month-end close processes prone to manual errors and audit concerns

Industry reports show that a significant percentage of firms in the region are re-evaluating their internal finance models in an effort to stabilize operations and ensure compliance under increasing scrutiny from both regulators and stakeholders.

Outsourcing as a Structured Financial Strategy

To address these challenges, a growing number of companies in Tennessee are turning to outsourced AP and AR management services. These outsourcing arrangements provide access to trained finance professionals, established procedures, and automated systems that support timely processing, reduce error rates, and enable consistent reporting.

Outsourcing is no longer viewed purely as a cost-saving tactic. Today, it represents a strategic realignment—one that enables organizations to refocus internal resources on critical business areas, while financial operations are managed by specialists equipped to handle high volumes, regulatory compliance, and process optimization.

Executives in the region acknowledge that AP and AR are not just transactional functions—they are essential components of financial health. Late payments, backlogs, and poor cash visibility can impact not just operations but also credit ratings, supplier trust, and investor confidence.

Observable Benefits of Outsourced Financial Processes

Evidence from across various sectors suggests that outsourced AP and AR management can produce measurable improvements in performance, accuracy, and audit readiness.

Key benefits reported by companies using outsourced models include:

1) Operational Efficiency: Repetitive tasks like invoice entry, payment processing, and cash posting are executed more accurately and consistently, freeing in-house teams to focus on core AP/AR efficient strategy.

2) Cash Flow Stability: Structured follow-ups and timely receivables help maintain predictable inflows, while accurate vendor payments reduce disruptions.

3) Compliance and Reporting: Standardized workflows aligned with regulatory requirements simplify documentation, audits, and financial oversight.

4) Scalability: As businesses grow, outsourced solutions offer flexibility to expand finance operations without new internal hires.

5) Technology Leverage: Outsourcing partners bring access to process automation and financial tools, reducing dependency on legacy systems.

These outcomes are drawing the attention of finance leaders in Tennessee, particularly those tasked with improving transparency, reducing costs, and maintaining control over essential financial functions.

Case Examples Highlight Value of Outsourcing

Firms operating within and beyond Tennessee have documented substantial gains after transitioning to outsourced financial models. For instance:

1) A retail enterprise in Tennessee reported an 85% reduction in invoice backlog and a notable increase in on-time payments within the first year of outsourcing its AP and AR functions.

2) A manufacturing firm based in Illinois saw a 92% improvement in payment accuracy, which led to stronger supplier relationships and smoother procurement operations.

3) A multi-location services company reduced month-end close time by 40% after implementing automated workflows supported by an outsourced team.

These case studies highlight how structured outsourcing models not only improve day-to-day finance operations but also contribute to broader organizational goals such as operational resilience and cost discipline.

Outlook: A Shift Toward Sustainable Finance Models

The adoption of outsourced AP and AR management is steadily rising across Tennessee, driven by a need for better financial control, improved reporting timelines, and more sustainable operational practices. As businesses continue to face pressure from regulators, markets, and internal stakeholders, the role of outsourcing in financial operations is expected to grow in both scope and importance.

Cut costs with expert finance support.

See Pricing Today: https://www.ibntech.com/pricing/

Industry analysts suggest that outsourcing will remain a key lever for businesses seeking to balance cost containment with operational reliability. For finance leaders, the transition to outsourced models represents not just a tactical choice, but a broader shift toward accountability, process maturity, and long-term organizational resilience.

Related Services:

Robotics process automation

https://www.ibntech.com/robotics-process-automation/

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive AR efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release